A central bank which is dedicated to deposites

- Inicie sesión o regístrese para enviar comentarios

I have mentioned a bit about banking in the other threads.

I have often wondered if the central bank (of a country, or of the world), or a central bank separate from the central bank, should have a bank dedicated to public deposits.

The bank would not invest or lend or borrow money, but would only specialize in storing the deposits it receives. So, of course, there is no interest on the deposit. However, the amount deposited is always guaranteed. It would not cost much to run, so no one would probably object to using taxpayer money to run it.

It would be possible to operate without charging fees for depositing and withdrawing money.

I think it would be the safest place to store assets. It also appears to be simple and efficient.

It always seems to me that problems arise because banks lend money.

Is that a wrong idea?

Just for the record, this is something I would like to ask in order to make a comparison with the cryptocurrency system (software).

I see one possible error in your thinking - I'm pretty sure it would cost a lot of money to run a large global deposit-only bank.

And turning everyone in the world into a tax slave to pay for their deposit-only central bank would probably make a lot of people angry. Especially since this bank could easily make enough money to pay for their costs by making loans and charging interest.

> It always seems to me that problems arise because banks lend money.

I don't think that lending money in and of itself is the primary problem. Not sure though. Maybe one of our resident socialists or communists will make their thoughts known. I've never studied the communist ideas regarding banking.

What I do know is that wealthy individuals and wealthy corporations get loans for 0% interest or close to 0%, while the vast majority of the population are debt slaves who pay much, much higher interest rates. This is one of the major problems that creates an ever-increasing gap of wealth inequality. And it creates an ever-increasing inability for the debt slaves to ever bridge that gap.

Today is International Worker's Day, so let's go.

> I've never studied the communist ideas regarding banking.

What a shame. As a staunch Marxist myself, I have, and thoroughly at that. And I can assure you they are close to non-existent. The bank is yet another bourgeois tool for the oppression of the masses that should be burned to the ground asap. Remember, all these tools are in fact paper tigers that shall be vanquished once the masses overcome their unjustified fears, as Mao Zedong said [1].

The somewhat capitalism friendly country that the US is, however, has a rich history of antitrust laws and banking regulations. The consequences of the unwinding of the Glass-Steagal act (that was passed in 1933 in order to limit systemic risks in the banking and financial sector by imposing a strict separation between lending and speculating, to sum up) from the early sixties on, and its eventual repeal in 1999, are still painfully felt today, and will probably continue to be for a while - by the enslaved worldwide debtors, that is.

In 2008-2009, the powers that be were facing a simple choice: put an end to the endless spiraling of the accumulated debt of the banking and corporate system and reform it, or keep inflating the problem until some external shock bursts the bubble. Because of the plutocratic nature of our current systems, the people who took the decision and the people who benefited from the status quo were the same people, so the outcome of the decision process was long foretold. To be sure, this is no conspiracy: just look at who is currently ruling Italy. Or France. Also, take a look at the polls there. And elsewhere too, that is of course a global malfunction.

I posted some random Yanis Varoufakis talks somewhere in the Troll Lounge. He calls himself a Marxist but he has in fact quite market friendly suggestions about how to radically rebuild the banking system. Only, social inertia is such, and so many people believe they have too much to lose to even dare pass a wind out of tune, that the actual outcome might well be much more painful. Tanks, bombs, fire, children crying, funeral arrangements, and so on and so forth. This is in fact a very serious point, but I believe we need to face the grimmest reality with a smile.

To make a short on-topic digression, I'd say that what the OP is talking about is usually called a vault or a safe. I heard they have very secure and very privacy friendly ones in Switzerland. I also heard there are many a strange thing hidden in there. Now I think about it, the only rational investment currently to be made is in super-secure and super-private vault hosting for the super-rich, with an equivalent degree of hardening to what is described there: https://www.infomaniak.com/en/hosting/datacenter-housing, plus a polycephalic dog or three as an option for the animal lovers.

> problems arise because banks lend money.

I would be tempted to rephrase this into: "problems arise because banks lend money they do not have to people who cannot repay." Hence the ever more indebted debt slaves and the permanently richer richest few. Fear not, though: they will soon fire themselves to Mars and roast half-way, as one of them recently predicted [2].

[1] https://en.wikipedia.org/wiki/File:Chairman_Mao-1.webm

[2] https://www.theguardian.com/technology/2018/nov/25/elon-musk-move-mars-chance-of-death

EDIT: added reference [2]. In fact it was announced three years ago already, but for some reason either it was repeated recently or media picked it only now.

NB: could someone please move this thread to the Troll Lounge? I have a feeling it has been marginally deviating from "free software, free culture, online privacy and related topics," in spite of a passing mention of Switzerland. Also, there is an unbearable typo in the title.

Really? I thought that was French. "Daaay-pose-eeeeets". Sounds very much like French strangulation of an otherwise perfectly efficient word.

I'm not sure.

Who would be disadvantaged by having our deposits fully protected by the banking function of the state?

Will it be the usual story that the centralized banking system has become corrupt and is now being decentralized to disperse the corruption and now that the Internet has matured so it is time to rebuild a decent corrupt centralized system again?

Who will suffer the loss and how... I wonder.

If banks could lend money they don't have, I don't think they would need our deposits. So perhaps even if the banks lose the deposit income, they can still invest and lend and borrow?

So even if they lose our deposits, it would not be a loss for the banks. Then who?

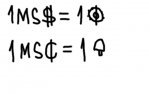

And should the citizens of any nation deposit their money in US dollar-denominated in the bank? Or should we create a new currency? Manger-Senpai dollar?

edit

The currency symbol was tentatively determined.

One (Manger-Senpai) dollar is pronounced as "One-omaaankoo".

One (Manger-Senpai) cent is pronounced like "One-otiintiiin".

edit: One-maaanko > One-omaaankoo

Lack of honorific title.

FYI I agree that this thread belongs in the Troll Lounge.

panties:

> The bank would not invest or lend or borrow money, but would only specialize in storing the deposits it receives. So, of course, there is no interest on the deposit.

I don't think people would keep much money in such a bank. As I understand it, one of the reasons for paying interest on deposits is because stored money loses value over time, because of inflation, so interest is an attempt to maintain the value of the deposits.

> It would be possible to operate without charging fees for depositing and withdrawing money.

As Andyprough pointed out, there would need to be some funding source to cover the significant costs of running a bank. Where do you anticipate the funding coming from if not from interest on loans or charging depositors fees?

> It always seems to me that problems arise because banks lend money.

Why do you think that? "Trading banks" don't actually lend deposited money, rather they issue new money into circulation when they make a loan, a power delegated to them by the state. In most countries they have to make sure their loans aren't more than 10 times the value of all their deposits, and policing this is one of the roles of the central banks. Mutual fund institutions like "credit unions" and "building societies" do lend depositors' money but you seldom hear about them running into problems as a result.

> I would like to ask in order to make a comparison with the cryptocurrency system (software).

The most important thing to understand when making such a comparison is why a token of "money" holds value at all. Fiat currencies - whether in the form of cash or numbers in a bank account - have their value guaranteed by the state that issues them (indirectly via trading banks, as described above). The value of crypto-tokens is entirely speculative, they are valueable to the degree that people believe they will hold their current value or increase it.

Japan and Switzerland have had a zero interest rate policy for about 20 years, the US since 2008, and the EU since 2016. Japan, Switzerland and Sweden have a negative interest rate policy.

Also, by limiting the denomination to US dollars (or MS$), it seems possible to keep the inflation rate at a reasonable level.

Therefore, it is my feeling that the incentive to receive interest on deposits, especially in modern developed countries, is unlikely to be higher than the incentive through risk management to have assets taken away in an undesirable event such as when payoff is triggered.

> Where do you anticipate the funding coming from if not from interest on loans or charging depositors fees?

Taxes. If all you have to do is manage the number that is not dependent on either nominal or real interest rates, it doesn't seem to cost much in terms of manpower or location if you have descent software and hardware. Perhaps even your one computer might be able to manage it.

> they issue new money into circulation when they make a loan,

I did not know that. Could you elaborate?

> more than 10 times the value of all their deposits

Not a tenth, but 10 times?

> Mutual fund institutions like "credit unions" and "building societies" do lend depositors' money but you seldom hear about them running into problems as a result.

There appears to be little or no harm in running a building society (housing finance association) or credit union on a small scale in the private sector if no appearance of so-called carpetbaggers.

In Japan, there is also a technology or a finacial system called Tanomoshikou[1], which seems to have been replaced by modern consumer finance, but the legal maximum interest rate for consumer finance is about 26% (And as a matter of course, all consumer lenders with loose screening set the maximum interest rate, and it is hard for young people working part-time to overcome the lure of easily borrowing 500,000 yen), which is a rather modern financial system compared to Tanomoshikou, which probably has no concept of interest. This means that the word credit, which used to refer to the literal trust of people within a mutual fund, has become a word that financial institutions use to refer to people's ability to pay.

But in English, it seems that the word "credit" for the ability to pay and the word "trust" when people trust each other were originally different. (Credit and trust)

> why a token of "money" holds value at all

The number on a loyalty card and the number of deposits in a bank account are the same number. One point on most loyalty cards has the same value as one yen. Conversely, the value of a bitcoin fluctuates against other currencies. Does this mean that the difference between a savings-focused bank and a cryptocurrency blockchain system is essentially the same as the difference between a currency with a fixed exchange rate system and a currency with a floating exchange rate system?

edit:forgot to attach this link [1]

https://en.wikipedia.org/wiki/Tanomoshiko

Shit, I should have written Texas...

The best bank is no bank. Since in communist society (estimated in early 22nd century), there will be no money at all.

How do people exchange things in that society?

If that society can achieve what Karl Marx said, "From each according to his ability, to each according to his needs", exchange seems not really needed.

I don't understand it. I cannot imagine such a society. Money is one of the best ideas human beings have ever created, and no exchange could be more efficient than using it. The fact that you rarely exchange means that you have to make almost everything yourself, such as the food you eat, the house you live in, and the computer you use.

The way I imagine is that if the needs and capabilities of production are evaluated and then work and distribution of products are planned accordingly, you are certainly not making yourself all what you need, you are contributing to make things for what you and other people need and so is everyone, but I don't see the need for money in that.

Of course, this requires organisation and collaboration of everyone and ensuring that the needs are really satisfied and people feel happy enough about the outcome.

Some people may see it as against their freedom but it could greatly reduce the efforts of everyone so that people would actually have more free time and peace of mind for their personal activities, including making non-necessary things, which could be art work but also alternative products. For the art, I think that is the motivation of Oscar Wilde in "The soul of man under socialism".

Well, if the money, the only most efficient exchange scale, is unnecessary in your society, that's fine, isn't it? Though, I still can't imagine it.

Well, it certainly doesn't seem to be a problem for artists who don't have anyone to support them in either capitalist or communist societies. The fact remains that people don't need such things in either society.

By the way, I always thought it would be better to not let the browser or other software show up on the top of the 2D desktop while you are typing a password or writing text, so that it doesn't interfere with your typing.

- Inicie sesión o regístrese para enviar comentarios