How do you work in your country ? what is your financial revenue ?

- Vous devez vous identifier ou créer un compte pour écrire des commentaires

On another place on the internet I spoke about how I "made" my life, so I wanted to ask you how you did ?

I'm a small tech repair/administrator, I was mainly taught/diplomed about MS os.

My work is simple I propose a yearly maintenance services for all computers in someones home.

I mainly focus on hardware repair/maintenance and migrating people on Trisquel when possible. I do not sell hardware.

73% of my CA* is going in to taxes.

What are these 73% ?

https://www.autoentrepreneur.urssaf.fr/portail/accueil/sinformer-sur-le-statut/lessentiel-du-statut.html

https://www.impots.gouv.fr/portail/particulier/questions/comment-declarer-les-revenus-provenant-de-mon-activite-de-micro-entrepreneur

Social charges:

-22% of CA* for services.

-12,80% of CA* for what you sell.

-22% of CA* for liberal status .

Incomes:

https://loadaverage.org/url/6136856

-71% of CA* for what you sell.

-50% of CA* for your services.

-34% of CA* for liberal activities.

Micro taxes:

-0.48% of CA for "taxe de chambre consulaire".

-0.3% of CA for "Contribution a la formation professionnelle"

-Plus one that changes from city to city but that's only if you have a shop.

I only do services so, 22+50+0.48+0.3=72,78% of CA*

*turnover/Chiffre d'Affaire

To generate minimum wage with such taxes I need to generate 67680 euros per year, and from that some I'm get 1 539,42 euros per month.

My new customers pay me 120 euros year to take care of all the computers in their home.

87,6 euros goes to the gov and I get 32,4 euros. With such taxes I need to manage a computer parc of 564 houses to generate the 67680 euros needed to get minimum wage.

This is named the "Auto entreprise régime" and it is clearly ludicrous, I'm going to see if there's anything better but I have low hope.

I also have a side project that can be declared as a non-lucrative entity so that people can pay for the software that they use, just a monthly contribution so that it is possible to pay at least a developer.

[Spoiler alert: this topic is 99% about how to do business in France and 1% about free software]

> 50% of CA* for your services.

This is the amount which is subtracted from your turnover before income tax rates are applied.

So it is actually 22.78% which go into social contributions, which is quite low compared to any other business status I am aware of.

Then you pay income tax on 50% of your turnover, so you somehow get 27.22% tax free. What is it you are complaining about exactly?

You can also opt for flat rate income tax rate (sort of), in which case you pay 1.7% of your turnover [1]. That still leaves you with a 75.52% net income.

To put this into perspective, as an employee doing the same job your net salary would probably be around 50% of the turnover you generate, at best. On which you would still have to pay income tax.

[1] https://www.impots.gouv.fr/portail/professionnel/le-versement-liberatoire

>is 99% about how to do business in France and 1% about free software]

Well it will if nobody else wants to speak about how they are making a living.

>This is the amount which is subtracted from your turnover before income tax rates are applied.

This IS the income taxe.

You get three different fiscal rates depending on what the income came from.

>So it is actually 22.78% which go into social contributions,

I do not understand how you get this number.

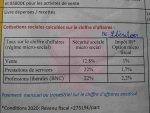

Picture and url/pdf (page16) related:

https://www.autoentrepreneur.urssaf.fr/portail/accueil/sinformer-sur-le-statut/guide-officiel.html

https://www.autoentrepreneur.urssaf.fr/portail/files/Guides/Metropole/Guide_Auto-Entrepreneur.pdf

>Then you pay income tax on 50% of your turnover, so you somehow get 27.22% tax free

>27.22% tax free

Again I do nut understand how do you get this number, I took a course for this specific regime and they teach us that it's, in my case, 22% of social charges on revenue, 50% fiscal imposition on the revenue plus the micro taxes which adds up to what I posted before.

>You can also opt for flat rate income tax rate (sort of),

That is a very special system that is very scamlike, imo to avoid, also you have to be under 27519 euros to be able to add it see picture and page 15.

Anyway besides that how do you make a living ?

> This IS the income taxe.

No, it is not. Again, this is the amount which is subtracted from your turnover before tax rates are applied, except if you have chosen to pay income tax upfront at a 1.7% rate applied to your quarterly (or monthly) turnover.

It is specified at the very beginning of the page you linked to [1]:

"Ce montant sera ensuite réduit automatiquement lors du calcul de votre impôt d'un montant forfaitaire (qui varie selon l’activité exercée par l’entreprise), à savoir :

- 71 % du CA pour les activités d'achat de biens destinés à être revendus en l'état, de fabrication de biens (en vue de leur vente), de produits à partir de matières premières (farine, métaux, bois, céramique...), de vente de denrées à consommer sur place, de fournitures de prestations d'hébergement ;

- 50 % du CA pour les autres activités industrielles et économiques ;

- 34 % du CA pour les activités libérales."

I have experienced it myself as a self-employed translator/reviewer/gardener/grasshopper/placeholder/whatever and it is a rather convenient status as long as your activity only requires immaterial capital.

> I do not understand how you get this number.

I took the 50 away from your own addition.

> Again I do nut understand how do you get this number

Once you have paid your 22.78% in various taxes and contributions, you are left with 77.22% of your turnover. You are taxed on 50% of your turnover as a basis for your net revenue (net before income tax, that is) so you still have 27.22% on which you have no income tax to pay (100-22.78-50=27.22).

> 50% fiscal imposition on the revenue

Either whoever told you this does not know what they are talking about, or you might have misunderstood. Nobody pays 50% on any portion of their revenue in income tax in France, the highest income tax rate is currently 45% [2] and is only applied to revenues in excess of €157,807. I can only wish you to have to pay that rate on your revenues :)

> That is a very special system that is very scamlike, imo to avoid, also you have to be under 27519 euros to be able to add it

Why would you necessarily avoid a flat income tax rate after which you have nothing more to pay? If you are doing in the vicinity of the €27,519 ceiling, your global income tax rate would otherwise be around 6%. If you have no other revenues, that is. If you are making over €27,519 in net taxable income (which is what that ceiling is referring to) then you can decently say you are making a living.

[1] https://www.impots.gouv.fr/portail/particulier/questions/comment-declarer-les-revenus-provenant-de-mon-activite-de-micro-entrepreneur

[2] https://www.service-public.fr/particuliers/vosdroits/F1419

- Vous devez vous identifier ou créer un compte pour écrire des commentaires